Raise your hand if you don’t like money!

Zero hands are up. Of course! Who doesn’t enjoy having enough money to fulfil dreams and aspirations? Having just enough to scrape through the bills leaves us with nothing to actually enjoy this beautiful planet we call home.

Still, a majority of us feel like we’re miles away from financial success. We may have ambitious plans to fulfil and bucket lists to check off, but these seem impossible to achieve because financial success seems so out of reach.

As with every problem, there’s a solution to this one as well!

It’s time to explore the barriers hindering your journey to prosperity. Let’s look into seven common reasons that hold us back from financial success. We’ll also take a look at modern investment opportunities and go through a simple, 4-step plan that can set us on the path to financial success!

Why Am I Not Achieving Financial Success?

1. Lack of clear financial goals

One of the primary reasons for financial struggles is the absence of well-defined financial goals. Without clear objectives, it gets challenging to stay focused and motivated on our financial journey. Setting achievable short-term and long-term goals is important for guiding our financial decisions and tracking progress.

Many of us are unsure about what we want to achieve financially. Otherwise, we’re often intimidated by the idea of setting goals around personal finance. This lack of clarity can lead to aimless financial decisions, leave us unprepared for financial emergencies and prevent us from realizing our true potential.

Solution: The importance of setting financial goals cannot be understated. Take the time to establish specific and measurable financial goals. Divide them into short-, medium-, and long-term targets, such as paying off debts, saving for a home, or planning for retirement. This sense of direction will boost financial discipline and provide a sense of purpose.

2. Fear of taking risks

Avoiding risk limits our financial growth potential. While it’s natural to be cautious about our finances, being overly risk-averse can also prevent us from seizing valuable growth opportunities.

The fear of losing money or making mistakes can lead to a conservative approach that hinders our ability to capitalize on investments with potentially higher returns. Playing it safe is necessary, but playing it too safe leads us to miss out on chances for significant financial gains.

Solution: Educate yourself about different investment avenues and risk management strategies. Start with conservative risks and slowly work your way up. Diversify your portfolio to achieve a balanced approach that aligns with your risk tolerance and financial goals.

3. Procrastination and inaction

“I’ll start saving next month.”

“I’ll invest when I have more money.”

How often do we catch ourselves saying at least one of the above? Procrastination is a boulder lying on the path to our financial success. Delaying action can cost us precious time and the potential to grow our wealth.

Procrastination is a common behavior when facing overwhelming financial decisions. Whether it’s starting a retirement fund, investing in stocks, or buying real estate, the fear of making the wrong choice or taking the wrong decision can lead to inaction.

Solution: Boulders can be moved. Or broken into chunks that can be moved easily. Similarly, break an overwhelming task into smaller, manageable steps. Next, take immediate action by starting a savings account or investing even small amounts regularly. Small, consistent steps eventually lead to bigger, more disciplined actions.

4. Negative self-talk and limiting beliefs

Sometimes, we find ourselves making statements such as “I’m not good with money” or “I’ll never be wealthy”. Negative self-talk can create mental barriers that hinder our progress.

Our beliefs about money and success influence our financial decisions and actions. If we constantly doubt our abilities or believe that financial success is unattainable, we will inadvertently sabotage our own efforts.

Solution: It’s time to take control of your thoughts. Reprogram your mindset with affirmations like “I am attracting abundance and prosperity into my life.” Cultivating a positive outlook and reminding yourself that you are capable of achieving financial success will help you turn these thoughts into action.

5. Neglecting personal finance

When evaluating what the reasons for our financial struggles are, we need to introspect to find the answers. Ignoring our financial situation and failing to budget are the first few reasons that will pop up. Without a solid understanding of our money’s inflows and sources, outflows and reasons, and savings, it’s easy to overspend and undermine our financial security.

Financial ignorance can cause problems like reckless spending, high debt, and a lack of savings. It can also leave us unprepared for unexpected expenses, resulting in unwanted stress.

Solution: Practice mindful spending and create a realistic budget. Track your expenses diligently, while looking for spending that you can cut back on. There are plenty of online tools and apps to help with expense tracking, often from all sources of income and spending.

A budget functions as a financial roadmap, helping you allocate funds for needs, wants, savings, and investments. By understanding your income and expenditures, you can whip your finances in shape and make informed decisions to improve your financial well-being.

6. Lack of financial planning

Not having a comprehensive financial plan can hinder our progress towards financial success. Just like we can get lost without a map, a lack of financial planning can lead us to make impulsive decisions that don’t align with our long-term objectives. We’re more likely to wander aimlessly, making financial decisions without considering their impact on our future.

Financial planning is all about evaluating our current financial situation, setting achievable goals, and creating a strategy to reach them.

Solution: Seek advice from a certified financial planner to help you create a tailored financial plan. A good financial plan should address your specific goals, risk appetite, risk tolerance, and investment strategies.

A financial planner can assess your financial situation objectively and design a plan that aligns with your goals. They can help you develop a diversified investment strategy and identify Investment avenues for proper financial growth.

7. Overlooking modern investment opportunities

The digital era of today has opened avenues for several modern investment opportunities. Being overly wary of these opportunities can hold us back from maximizing our financial growth potential.

We’re creatures of habit and, often, of tradition. This makes us stick with investment options like our parents, with the idea that they’re safe and reliable. While this isn’t completely wrong, we’d be doing our financial goals a disservice if we didn’t explore investment avenues that are cutting-edge and provide attractive returns.

Solution: Explore new investment options, including peer-to-peer lending, real estate crowdfunding or REITs, alternative investments, and cryptocurrency. Diversifying your investment portfolio can increase your chances of financial success.

Traditional investments still have their place; branching out into modern opportunities can offer diversification benefits and the potential for higher returns. Conduct thorough research and seek professional advice when venturing into novel investment territories for the first time. Remember, no investment avenue is risk-free. Your risk appetite must balance with the investments you make.

How Can I Overcome Obstacles to Financial Success? A 4-Step Plan

Step 1: Reflect on your financial goals and values

Consider your short-term requirements and long-term aspirations, aligning them with your core values to create a sense of purpose.

Identifying your values can guide your financial decisions, which in turn will help you prioritize expenses and investments that align with what truly matters to you.

Not everyone wants to retire super-wealthy, as long as they have a comfortable kitty of funds to get by on. Similarly, not all of us want a simple lifestyle. By understanding our motivations, we can stay committed to our financial goals, even in challenging times.

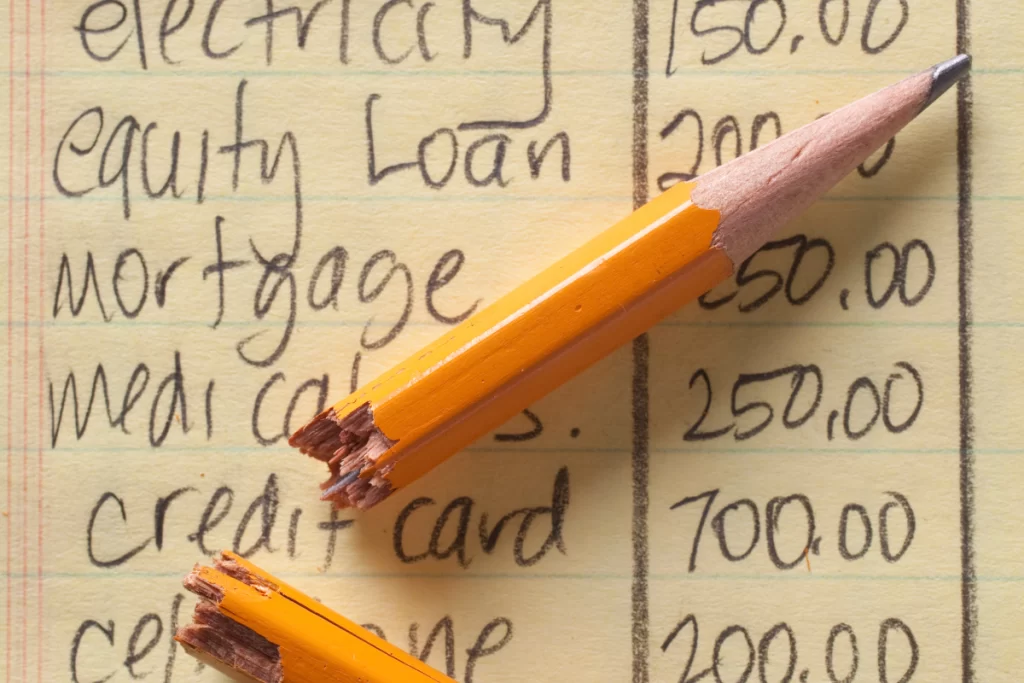

Step 2: Create a budget and savings plan

Develop a comprehensive plan that outlines your income, expenses, and potential savings. Next, identify areas to cut back on unnecessary spending. Set specific timelines for achieving small goals, and measure your progress.

Budgeting is the foundation of financial success. By tracking expenses and understanding your cash flow, we can optimize our financial resources, thereby avoiding living beyond our means. It also helps us make savings a priority.

Step 3: Educate yourself about financial planning and investments

Education is by far the best investment we can make for ourselves. And what better way to reach financial success than to invest time and effort in educating ourselves about personal finance, investment strategies, and modern opportunities?

The more we know about personal finance and investments, the better equipped we are to assess risks and rewards. Knowledge is power, and with knowledge comes the confidence to overcome financial obstacles and a negative mindset.

Step 4: Seek professional guidance from a certified financial planner

Financial planners are experts in their fields. They analyze our financial situation and devise strategies to improve it. They can offer personalized advice and provide objective recommendations to optimize our financial choices.

This takes away the burden of choosing the right investment avenues that will help us reach our goals. Relying on an expert can push us in the right direction on the path to financial success.

To Wrap Up

Overcoming obstacles to financial success demands self-awareness, perseverance, and a positive mindset. Setting clear goals, embracing risk to an extent, and educating ourselves about investment opportunities are just some strategies to get to the ultimate goal.

With unwavering commitment and the right help, we can pave the way for a more prosperous financial future.