As a child, I dreamt of a rosy, carefree life that revolved around travelling the world, eating the best foods, spending ample time with family and friends, and buying everything I desired. All of this took place in my head, with zero attention given to the price tag of it all. The personal financing required to achieve this life never featured in my daydreams.

Then I grew up.

While I still hold on to that dream, the realities that now ground me are the ones that are important to all of us – planning a budget, saving money for a rainy day, reducing debt, and so on. It’s always great when you can make financial choices early in life, learning from struggles of others. But what does one do now? How do we manage our money today?

While managing personal finances can be a bit tricky, we can go a long way with the right budgeting techniques and personal financing strategies. Be it achieving a short-term financial goal such as buying that state-of-the-art Bluetooth speaker, or fulfilling a long-term goal such as buying a home, personal finance management is the way to go.

First, let’s address an important question.

What is Personal Finance Management?

Personal finance management refers to the process of efficiently managing our financial resources – income, expenses, savings, and investments. It involves making informed and goal-oriented decisions about budgeting, debt elimination, and short-term and long-term financial planning to achieve financial well-being.

Why is Personal Finance Management important?

The goal of personal finance management is to make our money work in our favour, as opposed to the other way around. Simple, right?

With that goal in mind, here are reasons as to how financial planning and personal finance management tips can turn our financial woes into financial wins.

Building Financial Security

Who doesn’t want a strong and secure financial foundation? By tracking our income and expenses, creating a budget, and saving money, we can build an emergency fund, protect ourselves from unexpected expenses, and have peace of mind.

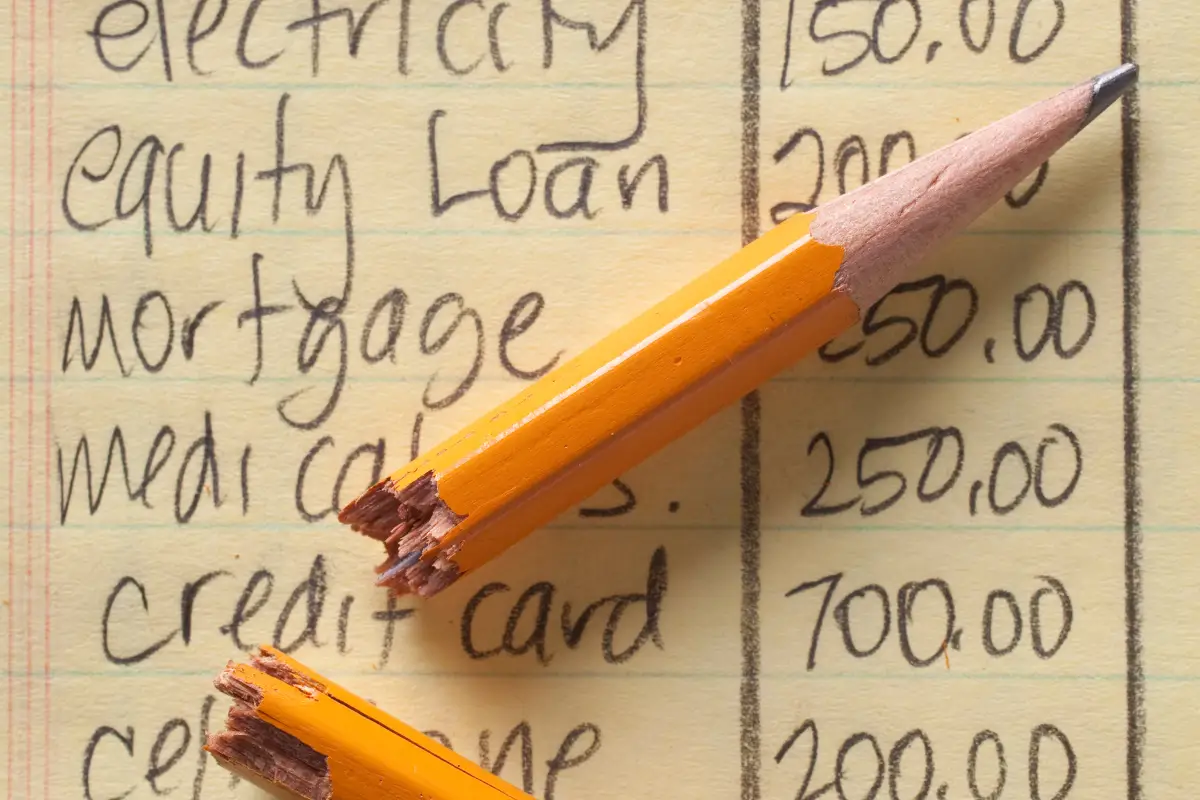

Debt Elimination

Too much of anything isn’t good, and that holds true for debt, too. We can regain control of our financial situation and avoid falling into the debt trap. A great place to start is incorporating debt elimination methods such as paying off our debts systematically and avoiding unnecessary debt.

Achieving Financial Goals

Whether it’s buying a house, starting a dream business, or planning for retirement, money management allows us to allocate resources wisely, save consistently, and invest intelligently.

Enhancing Financial Awareness

We develop a deeper understanding of our income sources, spending avenues and habits, and the value of money when we actively manage our personal finances. This awareness empowers us to make prudent financial decisions, prioritize expenses, and identify areas where we can save money.

Managing Income and Expenses

Optimizing our income and controlling our expenses becomes less stressful. By creating a budget, tracking spending, and finding ways to cut costs, we can maximize our savings potential and gain more control over our financial well-being.

How Can I Successfully Manage My Money?

Here are 7 tried-and-tested personal finance management tips to spare us from panicking and stressing about money inflows and outflows.

1. Create a Budget

The first and most important of all money-saving hacks is to develop a realistic budget. The budget should align with your income and expenses. Track your spending, categorize your expenses, and identify areas to adjust. There are plenty of apps out there, to help with these budgeting techniques. Reviewing and revising the budget is also important, to ensure it remains effective.

2. Automate your Savings

It’s a good practice to save at least 15%-20% of your monthly income. Setting up automatic transfers to a separate savings account or investment fund(s) removes the hassle of transferring funds each month. Of all the money-saving hacks out there, this one ensures that a portion of your income goes towards building your savings. It also removes the temptation to spend it elsewhere. Remember to appropriately increase the savings amount as your income grows!

3. Cut Unnecessary Expenses

While it’s fine to indulge some of our wants, not all of them help us in the long run. Identify expenses that are not essential or do not align with your financial goals. Reduce discretionary spending, such as eating out multiple times or impulse purchases. Cancel unused subscriptions, unsubscribe from marketing emails that are overtly tempting and switch to cost-effective alternatives wherever possible.

4. Seek Repayment on Time

There are multiple situations when we split a bill with our friends or colleagues. It could be for a restaurant bill during a night out, fare for the airport cab, or trip expenses for a weekend vacation to a hill station. In cases where you’re the one paying the bill, set expectations with the splitting party. These expectations should cover the amount each person has to repay, and the time by when the repayment should be done. You can use apps like Splitwise and Settle Up to track. Keep in mind that money is a sensitive topic, so be realistic, and gentle but firm with the expectations you set.

5. Prioritize Debt Repayment

Debt can be a source of constant worry, but by leveraging money management tips, we can manage debt efficiently. One of the popular debt elimination methods is to create a debt repayment plan that prioritizes clearing high-interest debts. Then, allocate a portion of your income to pay off debts systematically, one debt at a time. If needed, consider debt consolidation or refinancing options to reduce interest rates and simplify repayment.

6. Save for Emergencies

A rainy-day fund is essential to cover unplanned expenses. The aim should be to save 3-6 months’ worth of living expenses, to fall back on. Start small, and gradually increase the savings over time. This fund will reduce your dependency on credit or loans, if and when an emergency strikes.

7. Educate Yourself

Knowledge is power! Educate yourself constantly and consistently about personal finance topics. Read books on money management tips, follow financial blogs, and seek advice from trusted financial advisors. The more knowledge you have, the better equipped you’ll be to make informed financial decisions and optimize your money management strategies.

How to Create the Perfect Financial Calendar

Creating a financial calendar is a fantastic way to stay organized, keep track of important dates, and achieve your financial goals with ease. Here are 5 tips to help you create the perfect financial calendar:

1. Set Clear Goals

Start by defining realistic financial goals, whether it’s saving for a vacation, paying off debts, or retirement. Break these goals into actionable steps and assign them specific timeframes on your calendar.

2. Mark Income and Expenses

Identify your sources of income and recurring expenses. Highlight your payday, and set reminders for bill payments, rent, subscriptions, and other recurring expenses. You’ll never miss a payment and maintain a transparent view of your cash flow.

3. Track Savings Progress

Dedicate specific dates to review your savings progress. Use these milestones to assess your financial growth, adjust your saving strategies if needed, and celebrate your achievements along the way. Saving money doesn’t have to be boring or tedious!

4. Plan for Big Purchases

If you’re saving for a big-ticket item like a car or a home, incorporate milestones leading up to the purchase date. Break down the total cost into manageable savings targets and allocate specific periods to assess your progress and adjust your saving efforts accordingly.

5. Schedule Financial Reviews

Regularly schedule financial reviews on your calendar to assess your overall financial health. Use this time to analyze your budget, evaluate your investments, and make any necessary adjustments to your financial plan. Celebrating milestones achieved and progress made will keep you engaged and motivated.

By creating a financial calendar with these five points in mind, you’ll stay on top of your finances, meet your goals, and cultivate a positive relationship with money

So, In Conclusion

Managing personal finances and saving money should not be a daunting task. Financial stability is not a destination. It’s a journey that requires perseverance, discipline and a smart plan. Financial planning should be done in a way that helps us cultivate a positive relationship with money.

With a little bit of preparedness, we can be ready to tackle any bill, plan, emergency or financial goal, and fulfil our dreams – whether nurtured in adulthood or born from a child’s whim.

1 Comment